Key Features & Benefits of Term Insurance

Affordability

erm insurance policies typically have lower premiums compared to other life insurance products, making them accessible to a broad range of individuals.

High Coverage

Offers substantial coverage amounts, providing significant financial security for the policyholder’s family.

Flexibility

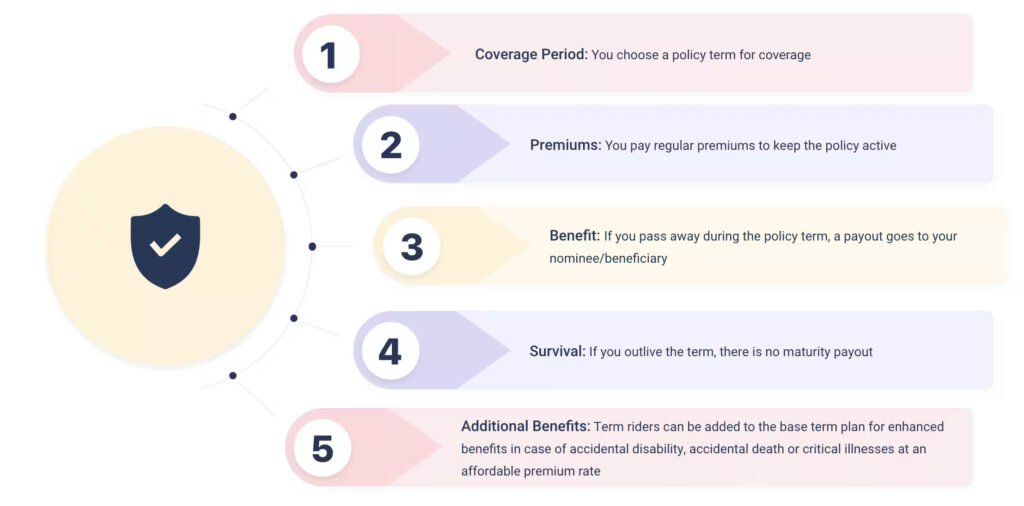

Policies can be tailored with various term lengths, ranging from 10 to 30 years, to match different financial goals and responsibilities.

Riders and Add-Ons

Optional riders, such as critical illness coverage, accidental death benefit, and waiver of premium, can enhance the policy’s protection.

Tax Benefits

Premiums paid for term insurance policies are eligible for tax deductions under Section 80C of the Income Tax Act, and the death benefit is generally tax-free under Section 10(10D).

Contact us

please Free to connect with us if you have any Query related insurance work